Portfolio Overview

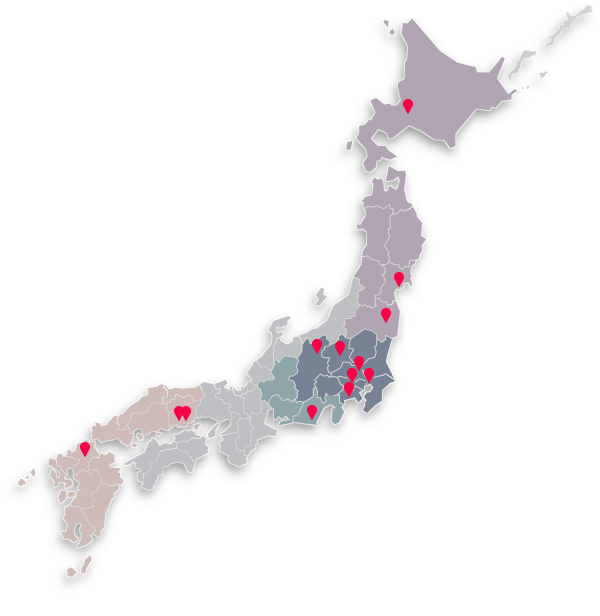

The portfolio currently comprises 19 modern logistics properties which are built to high specification. The properties are strategically located with proximity to transportation and shipping infrastructure. The portfolio has a high occupancy rate anchored by a diversified blue-chip tenant base which are involved in multiple sectors including 3PL and e-commerce.

The properties are mainly located in Japan, and one located in Vietnam, a growing market. The portfolio has a mix of built-to-suit single-tenanted and multi-tenanted properties, providing a balance of both long-term stability and opportunities for rent increases upon lease renewals, as well as a balanced mix of freehold and leasehold assets.

19

Number of

Properties

92.0 %

Occupancy

6.5

Years

WALE

As at 30 September 2025

Portfolio Statistics

- As at 30 September 2025.

- Based on independent valuation as at 31 December 2024.

- Based on independent valuation conducted as at 31 January 2025.

- Comprised the aggregate purchase consideration for property and freehold land.

- The ordinary land lease automatically renews for a term of 20 years unless otherwise agreed by the parties and the lessor will not be able to object to renewal without a justifiable reason.

Disclaimer

THESE MATERIALS ARE NOT DIRECTED AT OR INTENDED TO BE ACCESSED BY PERSONS LOCATED IN THE UNITED STATES.

Viewing this information may not be lawful in certain jurisdictions. In other jurisdictions only certain categories of person may be allowed to view this information. Any person who wishes to view this site must first satisfy themselves that they are not subject to any local requirements which prohibit or restrict them from doing so.

In particular, the units of Daiwa House Logistics Trust (“DHLT”, and units of DHLT, "Units") have not been and will not be registered under the United States Securities Act of 1933, as amended (the “US Securities Act”), and may not be offered or sold in the United States unless registered under the US Securities Act, or pursuant to an applicable exemption from registration. The Units are only being offered and sold outside the United States in reliance on Regulation S under the US Securities Act or otherwise pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements under the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. Neither this website nor any copy or portion of it may be sent or taken, transmitted or distributed, directly or indirectly, in or into the U.S. (including its territories and possessions, any state of the United States and the District of Columbia) or any other jurisdiction outside of Singapore.

This website are for information purposes only and does not constitute an offer of, or invitation to subscribe or purchase or solicitation of subscriptions or purchases of Units in any jurisdiction nor should it or any part of it form the basis of, or be relied upon in any connection with, any contract or commitment or any investment decision whatsoever. The information presented on this website is subject to change.

The value of the Units and the income accruing to the Units, if any, may fall or rise. The Units are not obligations of, deposits in, or guaranteed by, Daiwa House Asset Management Asia Pte. Ltd., as manager of DHLT (the “Manager”), HSBC Institutional Trust Services (Singapore) Limited (as trustee of DHLT), Daiwa House Industry Co., Ltd. (as the sponsor of DHLT), or any of their respective affiliates, advisers or representatives. An investment in the Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the Manager redeem or purchase their Units while the Units are listed. It is intended that holders of the Units may only deal in their Units through trading on the SGX-ST. Listing of the Units on the SGX-ST does not guarantee a liquid market for the Units.

This website may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Predictions, projections or forecasts of the economy or economic trends of the markets are not necessarily indicative of the future or likely performance of DHLT. The forecast financial performance of DHLT is not guaranteed. Investors are cautioned not to place undue reliance on these forward-looking statements, which are based on the Manager’s current view of future events. This website has not been reviewed by the Monetary Authority of Singapore.

If you are not permitted to view materials on this website or are in any doubt as to whether you are permitted to view these materials, please exit this webpage. By clicking on the "I agree" button below, you will have acknowledged the foregoing restrictions and represented that you are not located in the United States (within the meaning of Regulation S under the US Securities Act) and are permitted to proceed to electronic versions of these materials in accordance with the restrictions above. In each case, you acknowledge that you have read, understood and agree to comply with the disclaimer and restrictions set out above, understand that the disclaimer set out above may affect your rights and agree to be bound by the terms.